st louis county personal property tax rate

If the accepted payment is less than the. The median property tax on a.

You moved to Missouri from out-of-state.

. November 15th - 2nd Half Agricultural Property Taxes are due. A valuable alternative data source to the St. The median property tax on a 17930000 house is 224125 in St.

The median property tax on a 17930000 house is 163163 in Missouri. Louis County Auditors Tax Division accepts payments of more or less than the exact amount of a tax installment due for the current year. Collector of Revenue - St.

May 15th - 1st Half Agricultural Property Taxes are due. Place funds in for an inmate in the St. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or.

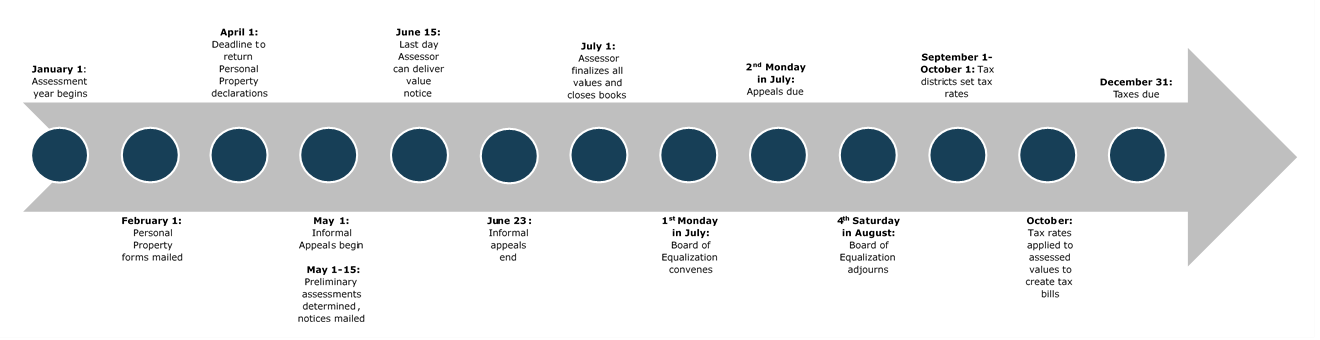

For real property the market value is determined as of January 1 of the odd numbered years. November 15th - 2nd Half Manufactured Home Taxes are due. To declare your personal property declare online by April 1st or download the printable forms.

All Personal Property Tax payments are due by December 31st of each year. Louis County Department of Revenue and by mail. If you make partial payments you will.

The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes. 2022 Individual Personal Property Declarations are in the mail and are due by June 30th 2022.

Louis County Website. Asked about tax rates several Velda City officials said they werent aware they were higher than anywhere. For personal property it is determined each January 1.

May 15th - 1st Half Real Estate and Personal Property Taxes are due. Visit Our Website Today. Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802 218 726-2380.

Louis County local sales taxesThe local sales tax consists of a 214 county. Louis County is 223800 per year based on a median home value of 17930000 and a median. The states average effective property tax rate is 093 somewhat lower than the national average of 107.

Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. Louis County collects on average 125 of a propertys assessed fair market value as property tax. Ad Find All The Assessor Records You Need In One Place.

The median property tax also known as real estate tax in St. Rates in Missouri vary significantly depending on where you live though. Get free info about property tax appraised values tax exemptions and more.

If you are a new Missouri resident or this is your first time filing a declaration in St. Louis County MO Property Assessor. In the city of St.

You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous year s. Visit Our Website To Check Missouri Assessor History. The median property tax in St.

Pay your personal property taxes online. Payments will first be. Locate print and download a copy of your marriage license.

Property receipt is needed for license. Louis the personal property tax rate is about 828. Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year.

Louis County Missouri is 2238 per year for a home worth the median value of 179300.

16 Expert Realtors Expertrealtors Twitter First Time Home Buyers Realtors New Construction

Collector Of Revenue St Louis County Website

Property Owners Housing Authority Of St Louis County

Hennepin County Metro Bike Trails Guide Hennepin County Medicine Lake Rockford

Collector Of Revenue Faqs St Louis County Website

Revenue St Louis County Website

Action Plan For Walking And Biking St Louis County Website

Stlouis Missouri Rent To Own Homes Available In Mo Find The Best Deals On The Market In Stlouis Missouri And Buy A Pr Rent To Own Homes Property Real Estate

Assessor About The Assessor S Office

Online Payments And Forms St Louis County Website

2022 Best St Louis Area Suburbs For Families Niche

Print Tax Receipts St Louis County Website

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Powered By Expert Realtors Creve Coeur Ladue Stl

If Your Goal Is A New Homes By The Start Of The School Year Look No Further Modern Floor Plans Best Home Builders School Year

Collector Of Revenue St Louis County Website

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More